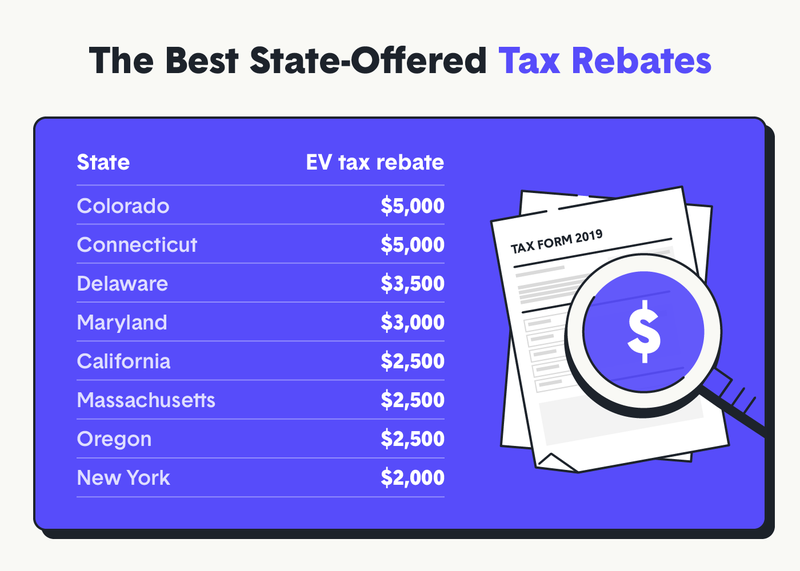

If you are a new york state resident looking for a new car it s a great time to buy or lease a plug in hybrid or battery powered car that qualifies for the drive clean rebate.

Electric car tax credit 2018 lease.

Why everyone leases electric cars rather than buying and maybe you should too.

Combine that with a federal tax credit of up to 7 500 and it s an opportunity you wouldn t want to miss.

All battery electric vehicles are eligible for the full 7 500 whereas some plug in hybrids with smaller batteries receive a reduced amount.

Electric car tax credits are available if they qualify.

The phase out of federal tax credits on the purchase of chevrolet plug in electric vehicles began when its gm parent hit its 200 000 unit cap at the end of 2018.

The credit amount will vary based on the capacity of the battery used to power the vehicle.

While someone who leases an electric car isn t eligible for the 7 500 federal income tax credit automakers usually but not always pass all or most of this amount to the buyer to lower the.

The exceptions are tesla and general motors.

Size and battery capacity are the primary influencing factors.

Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7 500.

Tax credits for heavy duty electric vehicles with 25 000 in credit available in 2017 20 000 in 2018 18 000 in 2019 and 15 000 in 2020.

Its stepped phase out to 50 started on april 1 2019 and continued until sept.

The week in reverse.

With more than 40 electric car models to choose from an.

Bolt ev in winter 2018 kia niro electric car tax credits 2018 nissan leaf news.

All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7 500.

There is a federal tax credit available for most electric cars in 2020 for up to 7 500.

2017 volkswagen e golf catskill mountains ny oct 2017.

Will there be a federal tax credit for electric cars in 2020.

The value of the irs tax credit ranges from 2 500 to 7 500 depending on the electric vehicle in question.